Money

Mapped: A Snapshot of Wealth in Africa

Mapped: A Snapshot of Wealth in Africa

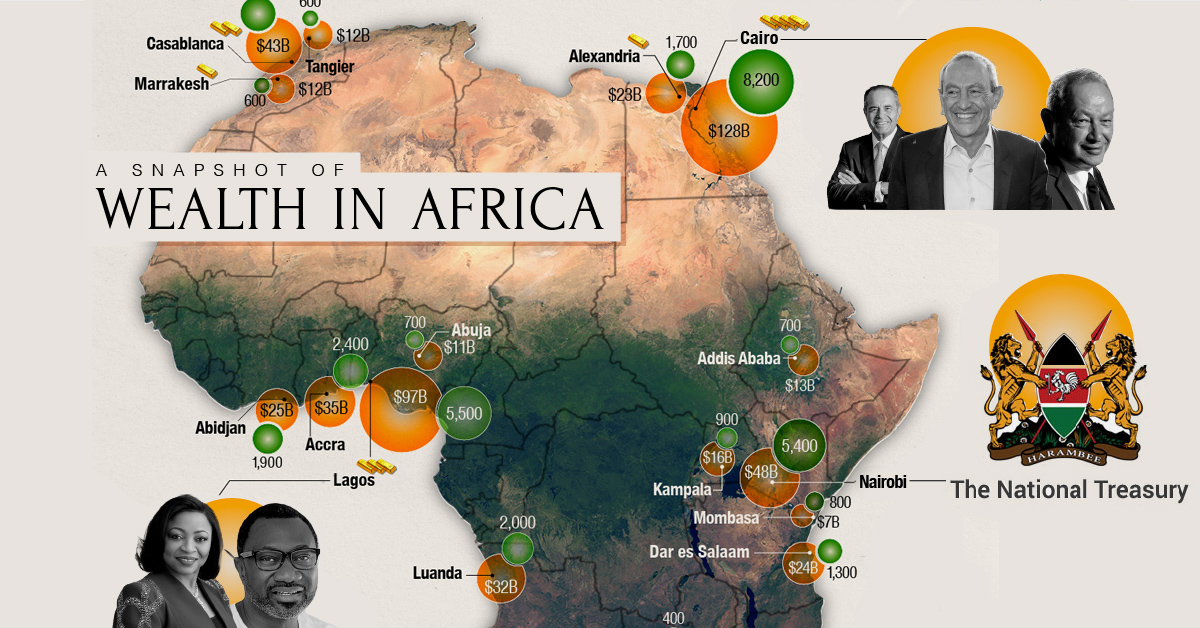

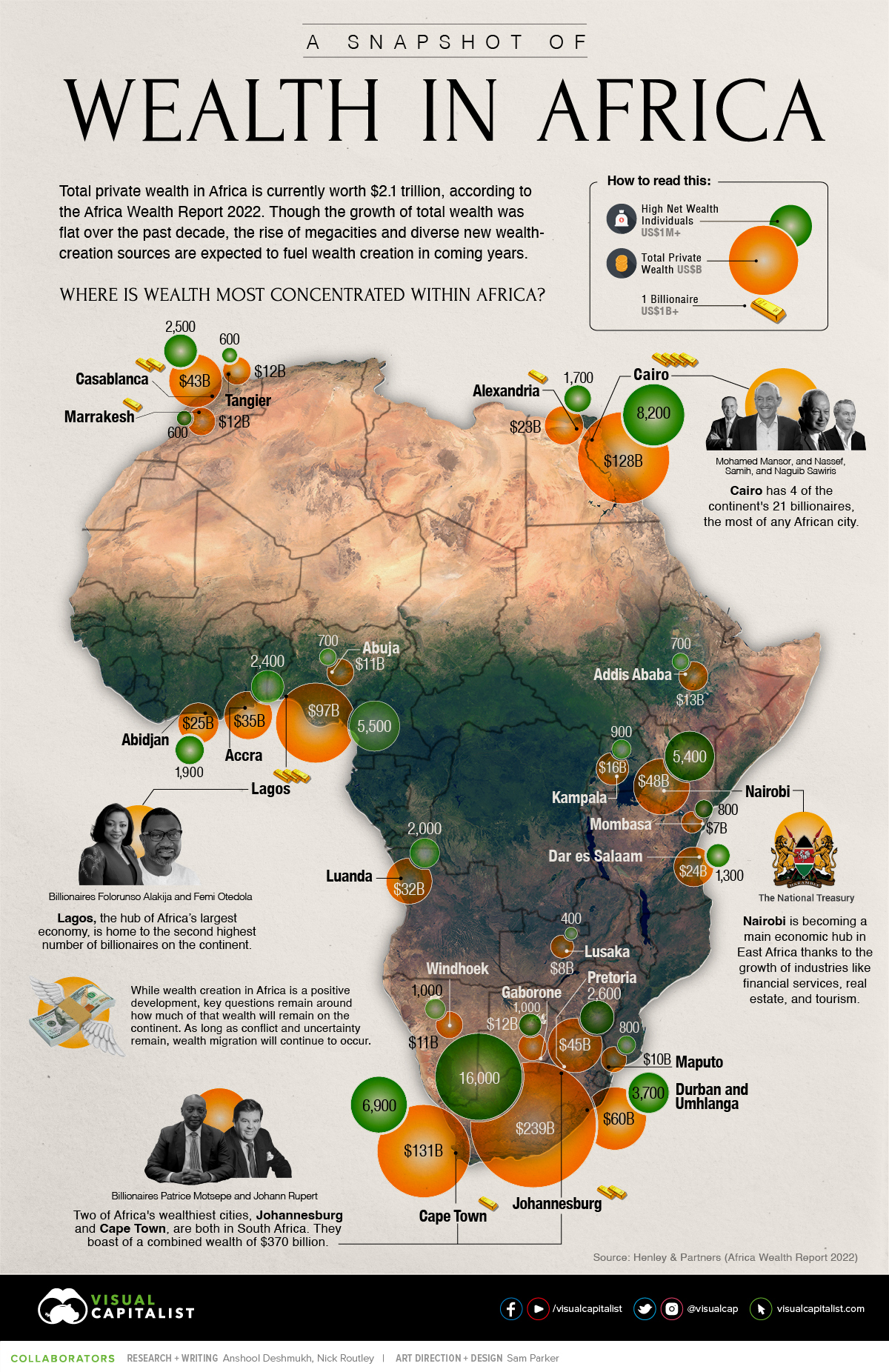

The continent of Africa contains more than 50 countries, but just five account for more than half of total wealth on the continent: South Africa, Egypt, Nigeria, Morocco, and Kenya.

Despite recent setbacks in Africa’s largest economies, wealth creation has been strong in a number of areas, and total private wealth is now estimated to be US$2.1 trillion. There also an estimated 21 billionaires in Africa today.

Drawing from the latest Africa Wealth Report, here’s a look at where all that wealth is concentrated around the continent.

A Country-Level Look at Wealth in Africa

South Africa is a still a major stronghold of wealth in Africa, with a robust luxury real estate market and ample wealth management services. The country is also ranked second on the continent in per capita wealth. That said, the country has faced challenges in recent years.

An estimated 4,500 high net worth individuals (wealth of US$1 million or more) have left South Africa over the past decade, migrating to places like the UK, Australia, and the United States. In one stark data point, the report points out that “there are 15 South African born billionaires in the world, but only 5 of them still live in South Africa.”

Here is how major African countries compare in terms of per capita wealth.

| Rank | Country | Wealth per Capita (US$) |

|---|---|---|

| #1 | 🇲🇺 Mauritius | $34,000 |

| #2 | 🇿🇦 South Africa | $10,970 |

| #3 | 🇳🇦 Namibia | $9,320 |

| #4 | 🇧🇼 Botswana | $7,880 |

| #5 | 🇲🇦 Morocco | $3,380 |

| #6 | 🇪🇬 Egypt | $3,000 |

| #7 | 🇬🇭 Ghana | $1,890 |

| #8 | 🇰🇪 Kenya | $1,700 |

| #9 | 🇦🇴 Angola | $1,620 |

| #10 | 🇨🇮 Côte d'Ivoire | $1,610 |

| #11 | 🇳🇬 Nigeria | $1,100 |

| #12 | 🇹🇿 Tanzania | $940 |

| #13 | 🇷🇼 Rwanda | $850 |

| #14 | 🇺🇬 Uganda | $820 |

| #15 | 🇿🇲 Zambia | $760 |

| #16 | 🇲🇿 Mozambique | $650 |

| #17 | 🇪🇹 Ethiopia | $540 |

Mauritius is Africa’s wealthiest nation on a per capita basis. Here are a few reasons why the island nation comes out on top:

- HNWI growth – Wealthy individuals have flocked to Mauritius in recent years

- Ease of doing business – Mauritius ranked 13th worldwide in World Bank’s Doing Business Report

- Low taxes – There is no inheritance tax or capital gains tax in the country

- Safety – Mauritius was recently rated by New World Wealth as the safest country in Africa

- Financial sector – A growing local financial services sector and stock market (SEMDEX)

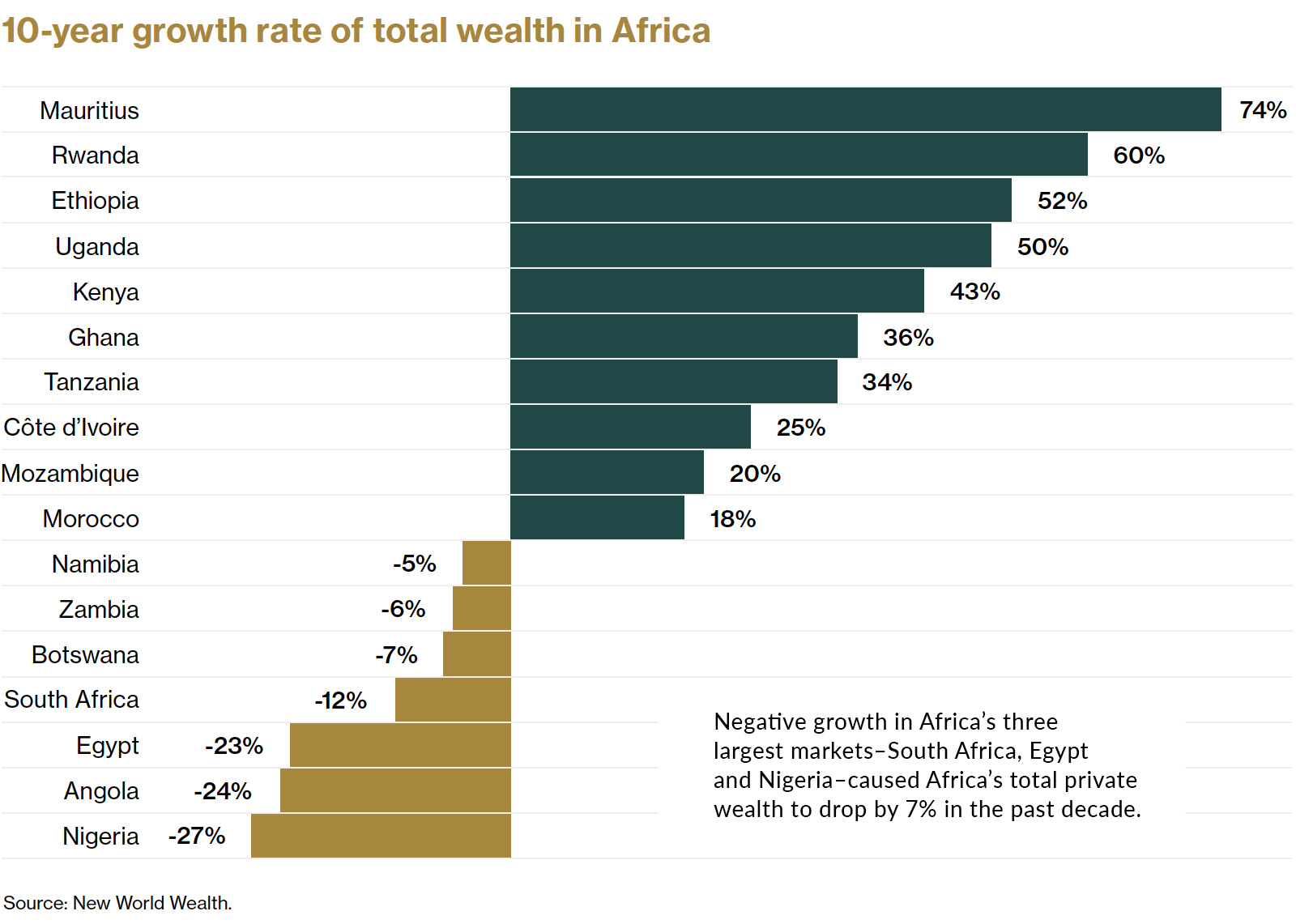

As a result, Mauritius has seen the strongest growth in total private wealth over the past decade, followed by Rwanda and Ethiopia.

On the flip side of the equation, Nigeria—which is Africa’s largest economy—saw a steep drop in total wealth. The country has struggled in recent years with high unemployment, corruption, and an over-reliance on crude oil.

The Big Picture

Over time, African countries are becoming less dependent on extractive industries, and business conditions are continuing to improve nearly across the board. These tailwinds, combined with the continent’s favorable demographics, point to a bright economic future for Africa.

The outlook for private wealth on the continent is largely positive as well. Total private wealth held in Africa is expected to reach US$3 trillion by 2031, an increase of close to 40%.

Economy

Ranked: The Top 20 Countries in Debt to China

The 20 nations featured in this graphic each owe billions in debt to China, posing concerns for their economic future.

Ranked: The Top 20 Countries in Debt to China

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we ranked the top 20 countries by their amount of debt to China. These figures are as of 2022, and come from the World Bank (accessed via Yahoo Finance).

The data used to make this graphic can be found in the table below.

| Country | Total external debt to China ($B) |

|---|---|

| 🇵🇰 Pakistan | $26.6 |

| 🇦🇴 Angola | $21.0 |

| 🇱🇰 Sri Lanka | $8.9 |

| 🇪🇹 Ethiopia | $6.8 |

| 🇰🇪 Kenya | $6.7 |

| 🇧🇩 Bangladesh | $6.1 |

| 🇿🇲 Zambia | $6.1 |

| 🇱🇦 Laos | $5.3 |

| 🇪🇬 Egypt | $5.2 |

| 🇳🇬 Nigeria | $4.3 |

| 🇪🇨 Ecuador | $4.1 |

| 🇰🇭 Cambodia | $4.0 |

| 🇨🇮 Côte d'Ivoire | $3.9 |

| 🇧🇾 Belarus | $3.9 |

| 🇨🇲 Cameroon | $3.8 |

| 🇧🇷 Brazil | $3.4 |

| 🇨🇬 Republic of the Congo | $3.4 |

| 🇿🇦 South Africa | $3.4 |

| 🇲🇳 Mongolia | $3.0 |

| 🇦🇷 Argentina | $2.9 |

This dataset highlights Pakistan and Angola as having the largest debts to China by a wide margin. Both countries have taken billions in loans from China for various infrastructure and energy projects.

Critically, both countries have also struggled to manage their debt burdens. In February 2024, China extended the maturity of a $2 billion loan to Pakistan.

Soon after in March 2024, Angola negotiated a lower monthly debt payment with its biggest Chinese creditor, China Development Bank (CDB).

Could China be in Trouble?

China has provided developing countries with over $1 trillion in committed funding through its Belt and Road Initiative (BRI), a massive economic development project aimed at enhancing trade between China and countries across Asia, Africa, and Europe.

Many believe that this lending spree could be an issue in the near future.

According to a 2023 report by AidData, 80% of these loans involve countries in financial distress, raising concerns about whether participating nations will ever be able to repay their debts.

While China claims the BRI is a driver of global development, critics in the West have long warned that the BRI employs debt-trap diplomacy, a tactic where one country uses loans to gain influence over another.

Editor’s note: The debt shown in this visualization focuses only on direct external debt, and does not include publicly-traded, liquid, debt securities like bonds. Furthermore, it’s worth noting the World Bank data excludes some countries with data accuracy or reporting issues, such as Venezuela.

Learn More About Debt from Visual Capitalist

If you enjoyed this post, check out our breakdown of $97 trillion in global government debt.

-

Technology6 days ago

Technology6 days agoAll of the Grants Given by the U.S. CHIPS Act

-

Uranium2 weeks ago

Uranium2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Education2 weeks ago

Education2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time

-

Energy1 week ago

Energy1 week agoRanked: The Top 10 EV Battery Manufacturers in 2023